Search Bitcoin

Search Models 3834

bitcoin 1:Bit Coin,2:Bitcoin

Most Popular Categories

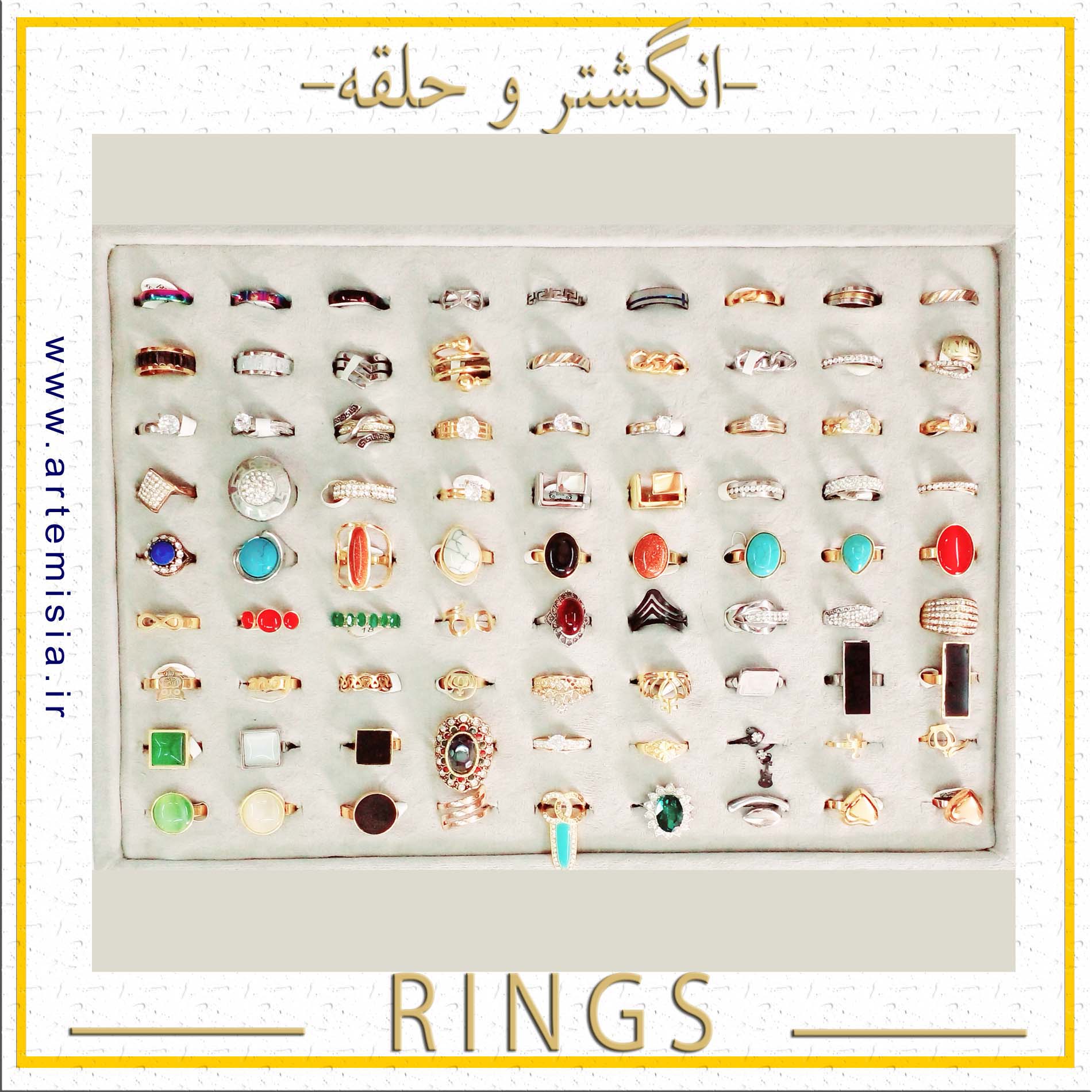

Rings

Steel Hoop,Free Size Ring,English Name Ring,Latin Name Ring,Persian Name Ring,Latin Name Bracelets,English Name Bracelet

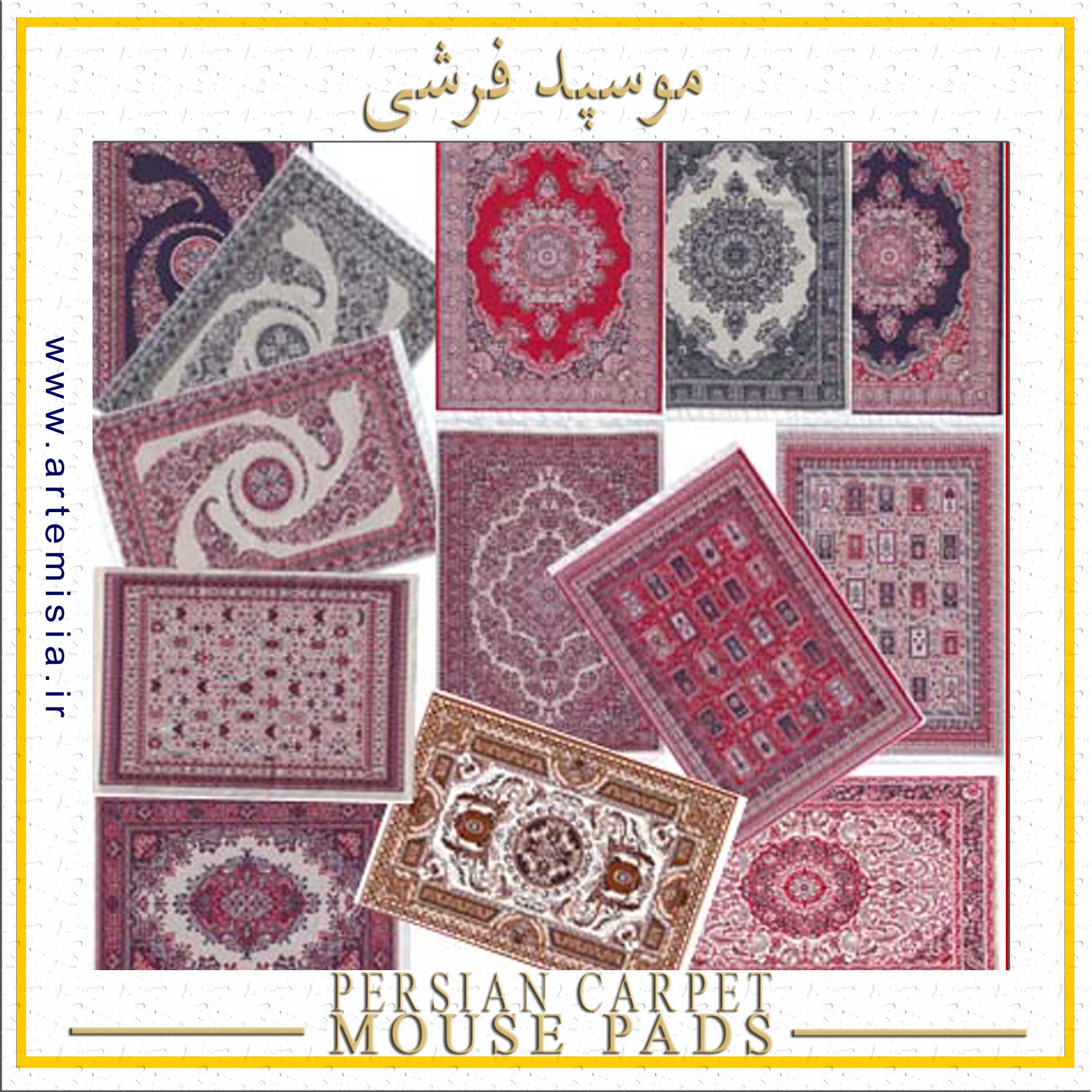

Carpet Mouse Pads

Iran Souvenir,Persian Rug Mouse Pad,Oriental Design Mousepads,Rug Mouse Pads,Persian Carpet Mouse Pads,Carpet Mouse Pad,Persian Carpet Design

Bracelets

Girls Bracelet,Elastic Bracelet,Plated Bracelets,Bracelet,Stone Bracelet,Knot Bracelet,Steel Bracelet

Necklaces

Necklace,Pearl Necklace,Artificial Yosr,Prayer Pendant,Rock Necklace,Resin Necklace,Black Necklace

Jewelry Set

Stainless Steel Half Set,Fixed Color Half Set,Solid Color Necklace,Golden Half Set,Girls Day Gift,Silver Half Set,Epoxy Resin Earrings

Hashtag Cloud

←bag←barrette←Beloved Names←big←black←box←bracelet←Bracelet Charm←Bracelet Charms←Bracelet Pendant←bronze←carpet←Carpet Design Mouse Pad←Carpet Design Mouse Pad Sale←Carpet Mouse-Pad←Carpet Mouse Rug←chain←Charm Pendant←clips←ear←earrings←elastic←English Name Ring←esi←eye←eyecatcher←Favorite Names←Free Size Ring←gold←golden←Golden Puzzle←hairband←Hair Clip←Hair Clips←iran←Iran Design←iranian←Iranian Design Mouse-Mat←Iranian Mousepad←jewelled←Latin Golden←Latin Name Ring←Latin Silver←love←Love Pendant←magic←Mainstream Names←medium←Men's Ring←metal←Metal Charm←mini←Mini Carpet←Most Beautiful Names←Most Common Names←Most Popular Names←Mouse Carpet Rug←mousepad←Mouse Pad Carpet←Mouse-pad Carpet Design←ms←Name Necklace←Name Pendant←Names Pendant←necklace←Necklace Charms←Necklace Pendant←normal←Om Pendant←Oriental Design Mouse Pad←pack←pendant←Pendant Necklace←Persia Carpet Mouse Pad←Persian Carpet Design←Persian Carpet Mouse Pad←persiancarpetmousepads←Persian Golden←Persian Name Ring←Persian Steel←piece←pin←purse←ring←rings←sh←silver←Silver Puzzle←simple←small←Sports Ring←steel←Steel Hoop←Steel Pendant←Steel Ring←stone←tablecloth←terme←termeh←Trendiest Names

Always SALE Artemis Not Just Moto!

- User Information Confidential

- Iran Shipping Only

- For information on inventory, wholesale & distribution please contact us

SEO Artemisia Search Bitcoin Bit Coin Online Trade

https://danamotor.ir/media/Artemisia_Shop_Iran_Gilan_Rasht.jpg

Link: http://artemisia.ir/artemis.php?langid=1&bejoo=Bitcoin

https://danamotor.ir/media/Artemisia_Shop_Iran_Gilan_Rasht.jpg

Link: http://artemisia.ir/artemis.php?langid=1&bejoo=Bitcoin

Contact Info

Artemis Iran

- Artemis Shop

Pamenar Xsection, #560 Galleria Mall Grand Bazaar of Tehran

+9821-55583681-82

Please call before visiting in person

Wholesale & Distribution Phone:+989227489149 - Gilan Branch: Rasht, Pejman St Phone: +989209792294

- E-mail: mimahoda@gmail.com